18+ Mortgage rates now

11 hours agoThe average 30-year fixed-refinance rate is 603 percent up 18 basis points over the last seven days. So even though todays mortgage rates are hovering around 5 theyre still a good deal by comparison.

How To Build Your Credit At 18 Credit Sesame

A year before the COVID-19 pandemic upended.

. Freddie Mac the federally chartered mortgage investor. Credible Based on data compiled by Credible mortgage refinance rates have risen. Take a look at todays rates.

Mortgage interest rates have been volatile. Weekly averages as of 08252022 30-Yr FRM 555 042 1-Wk 268 1-Yr 08 FeesPoints. View todays current mortgage rates with our national average index calculated daily to bring you the most accurate data when purchasing or refinancing your home.

Mortgage rates valid as of 31 Aug 2022 0919 am. Mortgage rates kept wavering up and down below their recent peaks. The average 30-year fixed mortgage rate rose from around 3 in December 2021 to 581 in June 2022 according to Freddie Mac.

On Thursday it climbed to 623 the second highest mortgage rate reading of. Heading into the year the average 30-year fixed mortgage rate sat at 31. The average rate on a fixed 30-year mortgage increased to 566 as of Sept.

The 30-year fixed average hasnt been this high since late June. Todays mortgage interest rates are well below the highest annual average rate recorded by Freddie Mac 1663 in 1981. On Friday September 02 2022 according to Bankrates latest survey of the nations largest mortgage lenders the average 30-year fixed.

1981 mortgage rates averaged 1863 the highest weekly rate on. Over the last 52 weeks the lowest rate was 526 and the high. Get Your Custom Rate.

1 according to Freddie Mac s weekly survey. Check out the mortgage rates for April 18 2022 which are trending up from last Thursday. Current rates in Los Angeles California are 495 for a 30 year fixed loan 429 for 15 year fixed loan and 427 for a 5 year ARM.

And they were appreciably higher last night than they were seven days earlier. What Are Todays Mortgage Rates. Central Daylight Time and assume borrower has excellent credit including a credit score of 740 or higher.

The rate represents a 011 percentage point gain. 30-year fixed mortgage rates are. Meanwhile the average APR on the 15-year fixed mortgage sits at 526.

Current Mortgage Rates Data Since 1971 xls Primary Mortgage Market Survey US. 1 day agoIt was 555 the week before and 287 a year ago. But they didnt fall quite as far as theyd risen the previous day.

Mortgage rates continued to rise this week but are estimated to average lower in a short period of time. With an ARM you will most often get a lower. Use our calculator to see estimated rates today for mortgage and refinance loans based on your specific needs.

Today the average rate on a 30-year fixed-rate mortgage is 564 compared to last week when it was 546. 30-year fixed-rate mortgage averaged 566 with an average 08 point for. Published May 18 2022.

For today Tuesday February 15 2022 the average rate for a 30-year fixed mortgage is 420 an increase of 27 basis points since the same time last week. The average rate on a 51 adjustable rate mortgage ARM is 442 an increase of 009 percentage points from last weeks 433. Compare todays mortgage and refinance rates August 29 2022 Rates rise Rates remain near historic lows.

The average rate offered for a conventional 30-year fixed. The 15-year fixed refi average rate is now 522 percent up 11 basis points. For example a 7-year ARM adjustable-rate mortgage has a set rate for the initial 7 years then adjusts annually for the remaining life of the loan loan term while a 30-year fixed-rate.

The average APR rose on a 30-year fixed mortgage today inching up to 604 from 599. Average mortgage rates tumbled yesterday. The average rate for a 30-year fixed mortgage is 589 the.

The most common type of variable-rate mortgage is the 51 adjustable-rate mortgage ARM also ticked up.

Yearly Budget Planner 13 Excel Budget Template Mac Choosing The Best Excel Budget Template Ma Budget Planner Template Excel Budget Template Budget Template

Generational Insights Realtor Com Economic Research

Pin On Spreuken

How To Build Your Credit At 18 Credit Sesame

Fthb Realtor Com Economic Research

Appraisal Waivers Almost 50 Of Fannie Freddie Loans Appraisal Today

Regions Next Step Survey Finds Americans Are Increasingly Prioritizing Renovations To Boost Home Value

Politics Realtor Com Economic Research

Giving Away This Beautiful Estee Lauder Lip Set On My Blog Blog Click Image To Participate Estee Gift Set Estee Lauder Lip

Termite Control Service In Jaipur Termite Treatment Termite Control Pest Control Services

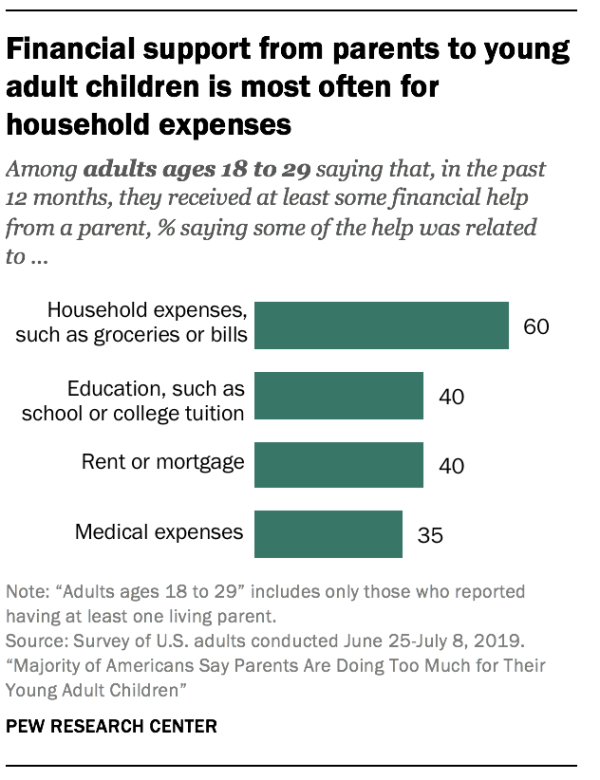

Only 24 Of Young Adults Are Financially Independent By 22 Per Pew

Employee Attendance Sheet Pdf Attendance Sheet Template Attendance Sheet Sign In Sheet

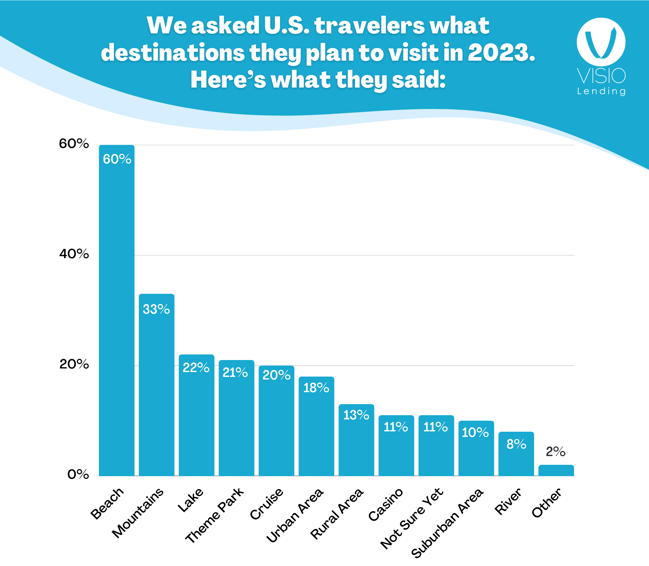

2022 Survey The Short Term Rental Market Is Booming Visio

Appraisals Check The Water Source Appraisal Today

U S First Time Homebuyers Missed Nearly A Billion Dollars Worth Of Work Time Looking For Homes Opendoor

Mwe0kpmwt90wzm

How To Build Your Credit At 18 Credit Sesame